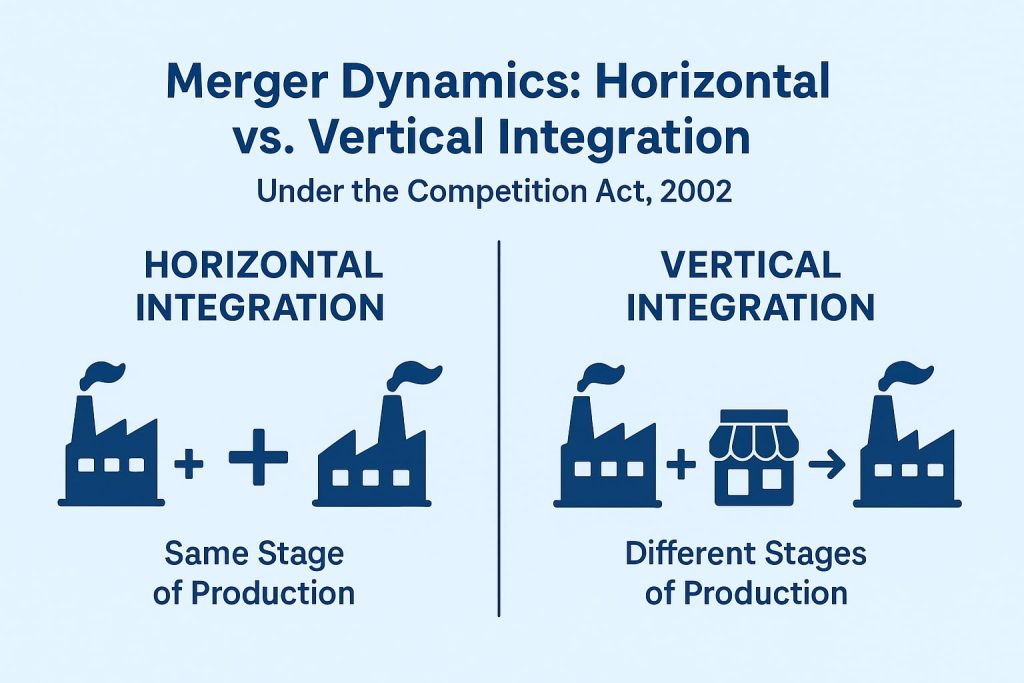

Mergers and acquisitions help companies grow, improve their market position, reduce costs, or combine resources. Two common types are horizontal mergers and vertical mergers. While both involve joining two businesses, they differ in purpose and effect: horizontal mergers happen between companies in the same industry, while vertical mergers occur between companies at different stages of the supply chain. Because these mergers can change how competitive a market is, they are closely examined under the Competition Act, 2002, which checks whether a merger might reduce competition, increase market power too much, or lead to unfair dominance.

- Horizontal Merger: Meaning, Purpose, Example, and Case Law

Meaning

A horizontal merger refers to the combination of two companies that operate at the same stage of the production or supply chain and typically within the same industry or market segment. These mergers occur between direct competitors—for example, two manufacturing companies producing similar goods, two telecom service providers, or two online marketplaces offering similar services.

Because such mergers involve direct rivals, they have the potential to reduce competition, create market concentration, and increase the risk of monopolistic behaviour. Consequently, they are scrutinised closely by competition regulators such as the Competition Commission of India (CCI).

Purpose of Horizontal Mergers

The primary objectives behind horizontal mergers include:

- Increasing Market Share: By merging with a competitor, the combined entity becomes larger and more dominant in the market.

- Reducing Competition: Eliminating a rival reduces price competition and enhances market power.

- Achieving Economies of Scale: The merged firm may benefit from reduced per-unit costs through larger-scale production, marketing, or distribution.

- Enhanced Operational Efficiency: Overlapping functions can be consolidated, reducing duplication of costs.

- Strengthening Bargaining Power: A larger entity can negotiate better terms with suppliers and distributors.

Example: Flipkart’s Acquisition of Myntra (2014)

A prominent example of horizontal integration in the Indian e-commerce space is Flipkart’s acquisition of Myntra in May 2014. Both companies were direct competitors operating in the same segment—online fashion and lifestyle retail—catering to largely overlapping customer bases. Although structured as a 100% acquisition rather than a statutory merger, it is widely regarded in competition law discussions as a classic horizontal merger because it combined two firms at the same level of the supply chain and eliminated a direct rival.

The Competition Commission of India (CCI) approved the transaction vide its order dated 24 June 2014 (Combination Registration No. C-2014/05/175), observing that:

- the combined market share remained moderate,

- strong competitors like Amazon, Snapdeal, and Jabong continued to constrain the merged entity, and

- the deal was unlikely to cause an appreciable adverse effect on competition (AAEC).

The acquisition allowed Flipkart to significantly strengthen its position in the fast-growing fashion segment, leverage Myntra’s specialised expertise, and achieve greater economies of scale in logistics, marketing, and technology—classic benefits of horizontal integration.

Case Law: Sun Pharmaceutical Industries Ltd. – Ranbaxy Laboratories Ltd. (2014)

A landmark horizontal merger case in India is the acquisition of Ranbaxy Laboratories Ltd. by Sun Pharmaceutical Industries Ltd., approved by the Competition Commission of India (CCI) in 2014 (Combination Registration No. C-2014/05/170).

Both Sun Pharma and Ranbaxy were leading generic pharmaceutical companies in India, manufacturing and marketing overlapping formulations in several therapeutic segments. The transaction resulted in the combined entity becoming the largest pharmaceutical company in India and the fifth-largest generics player globally.

The CCI identified horizontal overlaps in 49 formulations where the parties’ combined market shares exceeded 15%–20%. Recognizing the potential for appreciable adverse effect on competition (AAEC), the CCI approved the merger subject to structural remedies (divestiture of seven formulations to a third-party buyer). This case remains a textbook example of how the CCI addresses unilateral effects in horizontal mergers through targeted divestitures while preserving the efficiency benefits of scale in the pharmaceutical sector.

- Vertical Merger: Meaning, Purpose, Example, and Case Law

Meaning

A vertical merger occurs between companies positioned at different stages of the supply chain. Unlike horizontal mergers, these entities do not directly compete; instead, they operate in a supplier–buyer relationship or an upstream–downstream market structure.

Examples of vertical relationships include:

- A manufacturer merging with its raw material supplier.

- A wholesaler merging with a retailer.

- A broadcaster merging with a distribution platform.

Vertical mergers are often undertaken to increase efficiency, reduce transaction costs, and remove bottlenecks in the production or distribution chain.

Purpose of Vertical Mergers

Key objectives include:

- Ensuring Supply Stability: A company acquiring a supplier secures uninterrupted access to essential inputs.

- Reducing Transaction Costs: Integrated operations reduce negotiation, contracting, and transport costs.

- Improving Operational Efficiency: Companies can align production planning, logistics, and inventory management.

- Strengthening Competitive Advantage: Vertical integration can offer a competitive edge over rivals who remain dependent on external suppliers or distributors.

- Better Quality Control: Direct oversight over upstream or downstream processes enhances product quality and reliability.

Example: The acquisition of a majority stake in BigBasket by Tata Digital in 2021 is a clear example of a vertical merger.

Vertical Merger: Tata Digital (the upstream technology platform and digital services provider) merged with BigBasket (the downstream online grocery retailer and supply chain operator). They are not competitors, but rather partners in the supply chain.

Purpose: The goal was to connect Tata’s digital platform with BigBasket’s logistics and delivery system, leading to better inventory management, efficient last-mile delivery, and overall operational efficiency.

CCI Approval: The Competition Commission of India (CCI) approved the deal quickly because it found no significant harm to competition (AAEC). The CCI noted that:

- There was no direct horizontal overlap (Tata Digital didn’t sell groceries).

- The vertical arrangement would increase efficiency.

- The online grocery market still had strong rivals (like Amazon and JioMart), ensuring competition remains healthy.

Case Law (Vertical Merger): Walmart Inc. – Flipkart Private Limited (2018)

For vertical mergers, the CCI’s approval of Walmart’s acquisition of Flipkart in 2018 (Combination Registration No. C-2018/05/571) offers a strong Indian precedent with clear vertical elements. While the transaction had some horizontal overlaps in B2B wholesale, its most significant aspect was vertical integration between:

- Walmart’s upstream global sourcing and wholesale operations, and

- Flipkart’s downstream online retail marketplace platform.

The CCI found that the combination would enhance efficiency by improving supply-chain integration, reducing procurement costs, and enabling better inventory management. Crucially, the commission held that vertical integration in this case was pro-competitive and unlikely to lead to foreclosure of competitors, given the presence of strong rivals such as Amazon, Reliance Retail, and numerous physical and online distributors. The approval underscores the CCI’s approach of balancing efficiency gains against potential input or customer foreclosure risks in vertical mergers.

- Comparative Analysis: Horizontal vs. Vertical Mergers

A clear distinction between the two forms of mergers can be understood across several parameters:

- Market Position

- Horizontal mergers involve firms at the same level of the market.

- Vertical mergers involve firms at different levels of the supply chain.

- Impact on Competition

- Horizontal mergers pose a higher risk to competition because they eliminate a direct competitor.

- Vertical mergers generally pose lower risk, though they may create barriers for other competitors if integration is used to restrict access to essential facilities.

- Regulatory Scrutiny

- Horizontal mergers receive intense CCI scrutiny for potential market dominance.

- Vertical mergers are scrutinised for foreclosure risks, but regulators often allow them if they offer efficiency benefits.

- Economic Benefits

- Horizontal: Economies of scale, increased market power.

- Vertical: Supply security, operational efficiency, reduced costs.

- Main Concern

- Horizontal: Reduction of competition.

- Vertical: Exclusion of rivals from key inputs or distribution channels.

Conclusion

Horizontal and vertical mergers both change how markets work, but in different ways. Horizontal mergers happen when companies that compete in the same market join together. This can reduce competition and limit choices for customers. Vertical mergers happen when companies at different steps of the supply chain combine. These are usually done to cut costs and improve efficiency, but they can also block other competitors from entering the market. Under the Competition Act, 2002, regulators look at whether the benefits of these mergers outweigh the harm they might cause to competition and consumers. Real examples like Flipkart–Myntra and Zee–Dish TV, along with court cases such as CCI v. Coordination Committee of Artists and Bharti Airtel v. CCI, show how Indian regulators and courts study these differences in practice