What Each Structure Is

Private Limited Company

A corporate business entity registered under the Companies Act, 2013 with at least two directors and shareholders. It is suitable for scalable and growth-oriented businesses.

Limited Liability Partnership (LLP)

A hybrid structure under the Limited Liability Partnership Act, 2008 that combines benefits of a partnership and company with at least two partners.

One Person Company (OPC)

A company structure under the Companies Act, 2013 that allows a single entrepreneur to run a corporate business with limited liability.

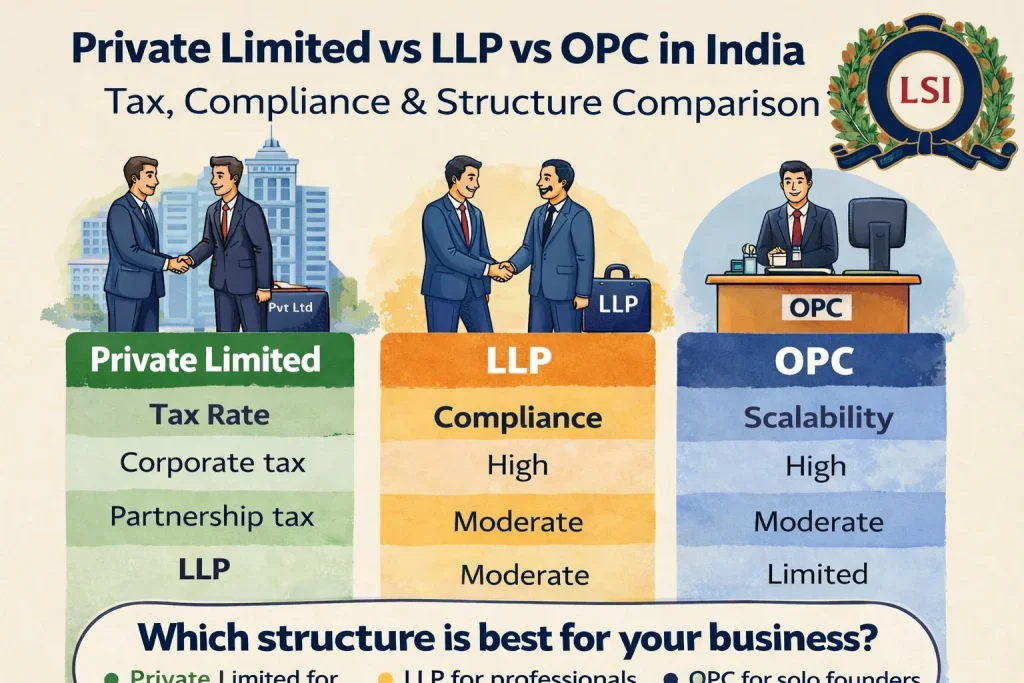

Key Differences At A Glance

| Feature | Private Limited Company | LLP | OPC |

|---|---|---|---|

| Owners | Minimum 2 shareholders | Minimum 2 partners | 1 owner + 1 nominee |

| Maximum Owners | Up to 200 | No limit | 1 |

| Legal Entity | Separate legal entity | Separate legal entity | Separate legal entity |

| Liability | Limited | Limited | Limited |

| Suitable for Investors | Yes – equity, VC, PE | No – cannot issue shares | Limited – no equity funding |

| Fundraising | Easy | Restricted | Very limited |

| Compliance | High | Moderate | Moderate |

| Tax Rate | Corporate tax | Partnership tax | Corporate tax |

| Scalability | High | Moderate | Limited |

| FDI Allowed | Yes | Allowed with restrictions | Not allowed |

Advantages And Limitations

Private Limited Company

Advantages

- Strong credibility and trust among banks, investors, and partners.

- Easy to raise capital from angel investors and venture capitalists through equity.

- Limited liability protection for shareholders.

- Perpetual succession (company continues despite changes in ownership).

- Can offer employees stock options (ESOPs).

Limitations

- Higher compliance (board meetings, annual reports, audits).

- More administrative and regulatory costs.

- More complex corporate governance obligations.

Best For: Startups planning rapid growth, external equity investment, scalable business models, and professional brand positioning.

Limited Liability Partnership (LLP)

Advantages

- Flexible management with minimal formal structure.

- Less annual compliance compared to Private Limited.

- Partners enjoy limited liability.

- Lower costs for maintenance.

Limitations

- Not investor-friendly; no equity shares or VC preference.

- Less credibility with large corporations compared to a Pvt Ltd.

- LLP profits taxed differently and no ESOPs.

Best For: Consulting firms, professional services, small-to-medium enterprises (SMEs), founders who want operational flexibility and low compliance costs.

One Person Company (OPC)

Advantages

- Allows a solo entrepreneur to run a company with limited liability.

- Enhanced credibility compared to sole proprietorship.

- Simpler management than a full Pvt Ltd company.

Limitations

- Cannot raise equity funding from investors.

- Limited scalability without conversion to Private Limited.

- Some compliance still required (annual filings, audits at thresholds).

- Foreign individuals cannot register OPC.

Best For: Solo founders, consultants, freelancers, and small business owners who want corporate structure with full control.

Tax And Compliance Comparison (2026)

Taxation

| Business Structure | Tax Treatment |

|---|---|

| Private Limited Company & OPC | Corporate tax rate (generally ~22–25%). |

| LLP | Taxed as a partnership entity (~30% on profits), no dividend tax. |

Compliance Requirements

| Business Structure | Compliance Obligations |

|---|---|

| Private Limited Company | Regular board meetings, annual returns, financial statements, statutory audits. |

| LLP | Annual Returns and Accounts; audit only if turnover or capital crosses thresholds. |

| OPC | Annual MCA filings and conditions similar to Pvt Ltd but simpler than full Pvt Ltd. |

When To Choose Which Structure (2026)

Choose A Private Limited Company If:

- You want to raise funds from investors or venture capital.

- You plan to scale nationally or internationally.

- You want credibility with banks, clients, and suppliers.

Choose An LLP If:

- Your business is service-oriented or professional practice.

- You want low compliance and flexible management.

- You do not plan external equity or institutional investment soon.

Choose An OPC If:

- You are a solo entrepreneur starting out.

- You want limited liability without partners.

- You may convert to Private Limited later when scaling.

Conclusion (2026 Perspective)

There is no “one best” structure for everyone. Your choice should be based on:

- Your business goals

- Plans for investment or partners

- Your compliance comfort

- How quickly you want to scale and expand

For ambitious startups with funding goals, a Private Limited Company is usually the strongest choice. For small teams and professionals, LLP offers flexibility and low compliance. For solo founders starting their journey, an OPC provides a legal corporate setup without partners.References:

- https://instabizfilings.com/private-limited-company

- https://instabizfilings.com/limited-liability-partnership-llp

- https://instabizfilings.com/blog/limited-liability-partnership-llp-act-2008

- https://instabizfilings.com/one-person-company

- https://instabizfilings.com/blog/corporate-tax

- https://instabizfilings.com/blog/employee-stock-option-plan-empowering-employees

- https://instabizfilings.com/blog/board-meetings-and-its-compliances

- https://instabizfilings.com/blog/corporate-governance-india-2025

- https://instabizfilings.com/blog/sole-proprietorship